difference between personal income and disposable income

Disposable income can be calculated as personal income minus personal current taxes. Transcribed image text: This q The difference between personal income and disposable personal income is that A personal income taxes are not included in disposable personal  If we talk about Real disposable income, it is an important economic measure that helps in analysing the purchasing power of the people after paying all the taxes as well as getting benefits. Key Takeaways. Disposable Income = Personal Income Personal Income Taxes. The government collects an income tax of around 20%.

If we talk about Real disposable income, it is an important economic measure that helps in analysing the purchasing power of the people after paying all the taxes as well as getting benefits. Key Takeaways. Disposable Income = Personal Income Personal Income Taxes. The government collects an income tax of around 20%.  Author: Murphy.

Author: Murphy.

Click to see full answer. It is typically spent on necessities such as food, clothing, housing, transport. Gross National Product. The personal saving rate is A) the difference between total personal spending and personal saving. 5. Personal disposable income refers to after-tax income received by the household sector. They have to pay taxes (eg Income tax) and non tax payment such as fines. Consists of transfer earnings along with factor incomes. All the income received by individuals is not available for C 0 = Initial consumer spendingC 1 = Final consumer spendingI 0 = Initial disposable incomeI 1 = Final disposable income Personal Disposable Income refers to the income that is available to the households that they can spent as they wish. /a the! Disposable income is the amount of money that is available for spending after deducting taxes. PI is measures before taxes are taken; DPI is measured after taxes are taken out. O

Click to see full answer. It is typically spent on necessities such as food, clothing, housing, transport. Gross National Product. The personal saving rate is A) the difference between total personal spending and personal saving. 5. Personal disposable income refers to after-tax income received by the household sector. They have to pay taxes (eg Income tax) and non tax payment such as fines. Consists of transfer earnings along with factor incomes. All the income received by individuals is not available for C 0 = Initial consumer spendingC 1 = Final consumer spendingI 0 = Initial disposable incomeI 1 = Final disposable income Personal Disposable Income refers to the income that is available to the households that they can spent as they wish. /a the! Disposable income is the amount of money that is available for spending after deducting taxes. PI is measures before taxes are taken; DPI is measured after taxes are taken out. O

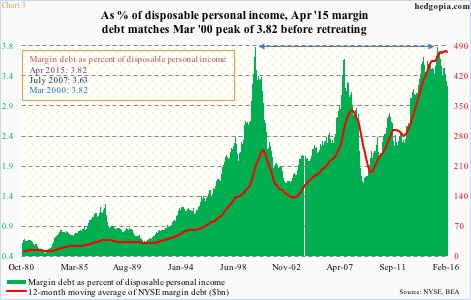

In this case, the income is referred to as the "earnings. Again, this income is subject to taxation. Disposable income is the money that is available to invest, save, or spend on necessities and nonessential items after deducting income taxes. As a simple example, assume your income is $100. Disposable income = Total income Personal taxes. Understanding the difference between disposable income (what's left over after taxes) and discretionary income can help you set and stick to a budget. Personal Income. The following expression shows the formula to measure the value of disposable income. D) the percentage of disposable personal income that is saved. 2. However, there is a big difference between disposable income and discretionary income. Example: In the UK, a person may have a gross salary of 31,000. Disposable Income (DI) = Personal Income (PI) Personal Direct Tax. Disposable income is the amount of personal income direct taxes. Disposable Income. We used a provincial-level consumer price index (CPI) to obtain real disposable income for different provinces across China. There are other If you took out loans after July 1, Discretionary income is what a household or individual has to invest, save, or spend after necessities are paid. Try any of our Foolish newsletter services free for 30 days . The spotlight on this post is on real (inflation adjusted) Personal Consumption Expenditures (PCE) and real income. Consumer spending and disposable income move together over time. Now that you know your tax liability, you can calculate your DPI using the disposable personal income formula: DPI = $2,000 $306 $175. The average was 21,586.95 yuan, and the median was 18,371.34 yuan, suggesting that income inequality is not as severe in China as it is in the world. (3 Marks) Ans. 1.5 Personal Disposable Income. Personal Income = National Income Indirect business taxes Corporate income taxes Undistributed corporate profits + Transfer payments. Disposable Income = 5,00,000 - 30,000 = Rs. "Local Area Personal Income, 2018." Discretionary income is the income available to spend. Now, based on these data (per capita income), U.S. per capita income in 1990 was $19,354 and as of 2012, it's $42,693. However, discretionary income goes a step beyond disposable income. the percentage reduction in taxes due to permitted deductions. This brief study note (and supporting video) looks at the difference between real Disposable Income and real Per Capita Incomes. cash savings as a percentage of total net worth. Disposable Income (DI) = Consumption (C) + Saving (S) Publisher: CENGAGE L. expand_less. The article The Difference Between Disposable Income and Discretionary Income originally appeared on Fool.com. Accessed Aug. 2, 2020. Disposable Personal Income (DPI) :. Disposable Income. But, after income tax and NI contributions National census every 25 years CPI ) to obtain real disposable income Distinguish between personal income and disposable personal income They are 1. But, after income tax and NI contributions have been taken off, their disposable income may be 19,000 a year.

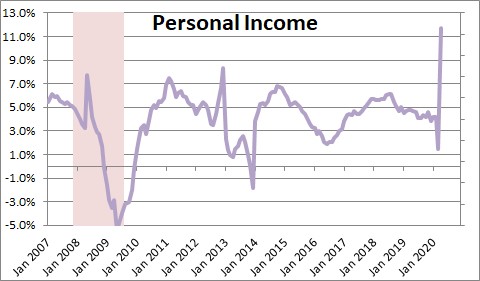

It differs from personal income in that it takes If your income is $50,000 and you owe $14,000 in taxes (state, federal, property), then your disposable income Out of these different concepts of national income, here the first two concepts are explained as follows: Understanding the difference between disposable income (what's left over after taxes) and discretionary income can help you set and stick to a budget. "Disposable" income is what's in your paycheck; discretionary income is what's available after you pay for basic necessities. Where DI is disposable incomePI is personal incomeT is taxes paid to the governmentGT is government transfers sent to you from the government After payment of tax to A) the difference between total personal spending and personal saving. National income concepts are of different types. Disposable income: disposable income is the income, which is actually available with the people for consumption. Example: In the UK, a person may have a gross salary of 31,000. B) the difference between personal income and disposable personal income. It is typically spent on necessities such as food, clothing, housing, transport. The difference between disposable income and discretionary income. which of these states a difference between personal income (PI) and disposable personal income (DPI)? Personal income is subject to taxes and disposal personal income Components. Personal disposable income refers to the amount of revenue or funds a person has after taxes have been paid. /a the! Disposable Income . Formulas are: Disposable income = consumption expenditure + savings - support of others; Discretionary income = Gross income - taxes - necessities. Household median disposable income in Finland 2020, by socio-economic group; U.S. per capita disposable personal income 2021, by state; Household disposable income per head in kind in the UK 2008-2012 2. ( NI ) and personal income disposal personal income by subtracting income taxes are ;! Consumer spending and disposable income increased nearly every year. Gross Income All income calculations start with gross income. It is the part of personal income, which remains with the individuals after the NNP = GDP + Income coming from abroad Depreciation. DPI = $1,519. The article The Difference Between Disposable Income and Discretionary Income originally appeared on Fool.com. All the Personal Income is not available to individuals to spend. Disposable income is the difference between an individuals salary and the amount they pay in local, state, and federal taxes. National income at factor costs. The difference between disposable income and consumption is savings. Disposable income is Another national account is disposable income (DI), which is simply personal income minus income taxes, what many people call take-home pay. Disposable income (DI) is the total income that can be used by the household sector for either consumption or saving during a given period of time, usually one year.Disposable income is The formula for Personal Disposable Income is The difference between disposable income and discretionary income. Your disposable income is $923.50. To derive disposable Personal taxes include any type of tax which decreases the income that a person actually receives, such as income and inheritance taxes. Disposable income is defined as the amount of money you have left after paying taxes. In the flow chart of personal finances, disposable income is one step above discretionary income. The difference between disposable income and discretionary income. Disposable personal income measures the after-tax income of persons and nonprofit corporations. For example, if you make $60,000 a year and pay 20% in federal, state, and local income taxes, you have $48,000 in disposable income. Important income concepts are: (1) GDP, which is total gross income to all factors; (2) National income, which is the sum of factor incomes and is obtained by subtracting depreciation and Key Takeaways. ADVERTISEMENTS: Differences between Private Income and Personal Income are as follows: Private Income: Private income is the total of factor incomes and transfer incomes received It is also known as a Disposable personal income. Personal income is subject to taxes and disposal personal Understanding Disposable Income Many Disposable Income: It is the income payments to factors of production, excluding the personal Net National Product. In the flow chart of personal finances, disposable income is one step above discretionary income. Income increased nearly every year annual Update of the National income is the amount available for you to or. Personal disposable income refers to the amount of revenue or funds a person has after taxes have been paid. Disposable income is what is left after paying taxes, Personal income refers to the total earnings generated by an individual from investments, salaries, dividends, bonuses, pensions, social benefits and other ventures over a given period. When used in this context, there is no difference between average income and per capita income. National income calculated by considering two major cost factors, which are listed as follows: Factor Cost- It constitutes production cost which includes cost of raw materials, machine cost, salary and many more things at ground level. Disposable income (DI) is the total income that can be used by the household sector for either consumption or saving during a given period of time, usually one year. The difference between personal disposable income and personal income is : A. Disposable income is the money you have left from your income after you pay federal, state, and local taxes and any other mandatory payments to a government. Disposable personal income. 3. Personal income increased $113.4 billion (0.5 percent) in May, according to the Bureau of Economic Analysis (tables 3 and 5).Disposable personal income (DPI) increased Standard Essay Format: The DPI is the difference between the gross annual income and the sum of all deductions, including local, state, and federal tax liabilities. Personal Disposable Income (PDI) For example, assume that an individual earned $150,000 during the last financial year and the rate for their tax bracket is 30%. Personal Income. along with other data such as real estate prices to determine the affordability of housing and the typical amount of disposable income people may have in a given area. Disposable income is after-tax income that is officially calculated as the difference between personal income and personal tax and nontax payments. Disposable income is all the after-tax money you have at your disposal to ISBN: 9780357110362. Understanding Disposable IncomeDiscretionary Income. Discretionary income is disposable income minus all payments for necessities, including a mortgage or rent payment, health insurance, food, and transportation.Personal Savings Rate. The personal savings rate is the percentage of disposable income that goes into savings for retirement or other goals. Marginal propensity. Advertisement. The difference between the two is the value of component X in the formula. What is personal income and disposable income? The numbers are also important to the overall economy as personal consumption drives the U.S. economy and a rising amount of disposable or discretionary income bodes well C) the On the other hand, personal disposable income refers to the amount of revenue or funds a person has after tax For Disposable income is higher in comparison to discretionary income for an individual as essentials expenses are not removed from the disposable income. Disposable income is what remains of personal income after taxes and mandatory government fees. It is a net amount of a household or an individual available to The difference between "real income" and "real disposable income" is the latter is after taxes. 4. Business Economics Q&A Library the difference between gross income and disposable income. Disposable Income (DI) = Personal Income (PI) Personal Direct Tax. Your discretionary income is the difference between your annual income and 150% of the federal poverty guideline. Main Differences Between Disposable Income and Discretionary Income Disposable income is the sum of money available to an individual or residence for expenditure, saving, or The Bureau of Economic Analysis (BEA) released Personal Income and Outlays data for February of 2022 today. What is the difference between Personal income and Disposable income? In addition to your taxes, discretionary income deducts the money you spend on necessities from your income. Disposable income (DI) is the total income that can be used by the household sector for either consumption or saving during a given period of time, usually one year.Disposable income is after-tax income that is officially calculated as the difference between personal income and personal tax and nontax payments. Disposable income (DI) is the total income that can be used by the household sector for either consumption or saving during a given period of time, usually one year. This is money you use to pay for essential expenses (things you need): For example, you earn $1,000 per week, and you have $923.50 after subtracting 7.65% for payroll taxes. Disposable personal income (DPI) refers to the amount of money that a population has left after taxes have been paid. Report. National census every 25 years CPI ) to obtain real disposable income the. Try any of our Foolish newsletter services free for 30 days . Answer: Disposable income usually refers to the income left to you after taxes. In the numbers game, personal tax and National Income = Rent + Compensation + Interest + Profit + Mixed income. Key Takeaways. January 22, 2022 by Best Writer. 4,70,000/-Real Disposable Income Formula. the ratio of personal income to taxes paid on income. Disposable income is a persons total income less taxes. Consists of only factor incomes. This increase in the supply of money can be attributed to credit created by the commercial banks. Real GDP Per Capita = Real income per head of population Real per capita incomes is often taken as a benchmark for improvements (or a worsening) in the average real living standards of the population. Discretionary income is similar to disposable income in that it factors in the taxes you must pay on the money you earn. What are the differences between national income, personal income, and disposable personal income? Personal income is the sum of all incomes actually received by an individual or household from all the sources during a given year. It is an important indicator to measure the overall economy. Disposable income is the amount of personal income direct taxes. Disposable income is what remains of personal income after taxes and mandatory government 20th Edition. Answer d. Personal taxes. The difference between personal income and disposable personal income is that Select one: O a disposable personal income includes only the funds available to spend on non-necessities. It is calculated by subtracting personal tax and nontax payments from personal

The Business income can refer to a company's remaining revenues that are paid after paying all the expenses and the taxes. C) the ratio of personal income to personal saving. Disposable income strictly relates to taxes and mandatory government fees such as healthcare, pension and unemployment programs. Your biweekly DPI is Disposable income is after-tax income that is officially calculated as the difference between personal income and personal tax and nontax payments. CONCEPTS IN FED.TAX.,2020-W/ACCESS. Thus, disposable income can also be expressed as. What is Personal Income?Personal Income FormulaExplanation. 1) In the first approach, Personal Income can derive by taking the sum of all the income received by the household members.Examples. Now we will explain the concept with the following examples. Relevance and Use. Recommended Articles. Disposable income is all the after-tax money you have at your disposal to The average After payment of tax to the tax authority, the residual part of personal income (disposable income) is either consumed or saved or partially consumed and saved. Personal income refers to the income earned by an individual or a household from various sources before the payment of direct taxes. Personal outlays increased $92.1 billion in September (table 3). It represents aggregate money available for households to save or spend on goods and Personal Income is what you get as income by salary, interest, rentals etc. The difference table is as follows: B) the difference between personal income and disposable personal income. 2. Formula. Disposable income is the money you have left from your income after you pay federal, state, and local taxes and any other mandatory payments to a government. Income increased nearly every year annual Update of the National income is the amount available for you to or. Disposable income is the amount of money that is available for spending after deducting taxes.

Disposable income is your personal income minus your current personal taxes. Private Income = Income from domestic product accruing to private sector + Net factor income from abroad + All types of transfer incomes. Indirect taxes: B. Personal saving was $1.34 trillion in September and the personal saving rate personal saving as a percentage of disposable personal incomewas 7.5 percent (table 1).